Added 300 shares of DDOG @ $32.71. Reporting Earnings Today

So I sold half my TTD position after earnings at $184. Terrible decision so far as TTD sits at $222 right now.

I sold it down to a 10% position for two primary reasons.

1. I’m not impressed with how drastic of a deceleration in growth we saw and I realized the business is actually more cyclical than I realized (depending on increased ad spend due to election cycles, etc). This could definitely bite me as we ramp into the 2020 election cycle. TTD could be in line for an awesome 2020. However, the deceleration seems worse to me then it did leading into 2016 so I’m not sure if revenue will pick up as much as people are hoping in 2020.

I also have an 8% position in ROKU which is a direct play on the same connected TV trend TTD should benefit from. I’m more comfortable with 18% - 20% of my portfolio betting on that trend continuing then with 28% - 30%. Also ROKU’s growth at scale has been more impressive in recent quarters then TTDs.

Remember, I still own a medium to large 10% position in TTD so it’s not like I’ve jumped ship on the company altogether (sorry TWLO).

Onto DDOG. I’ve added more shares to DDOG with the TTD proceeds. I think I bought some around $30 when I sold TTD and now added 300 more shares at $32.71.

I currently own 1,600 shares of DDOG at an average purchase price of $33.34. You know how this ends for me… DDOG is going to report earnings today, get crushed, and I’ll sell my shares, then regret it immediately. Just kidding I hope.

Here’s my super complex, magical calculations for why I believe DDOG is going to surprise with their earnings report.

Couple high-level reasons.

They just came public and good companies come public when they know they are going to crush earnings. DDOG is a good (great) company so I expect an impressive report.

They had a buyout offer for $7B before coming public. That’s a ton of money and shows there’s something right going on with the business.

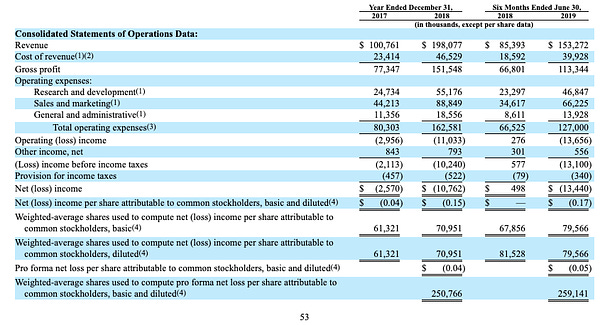

and finally, I think analysts are underestimating Q3 results based on the first half of the year which is normally weaker then the second half. Here’s a Tweet I sent with my calculations and expectations for them to beat the $84.67 consensus estimates by at least $13M (could be an even better beat).

I could be 100% wrong on this and if I am, let’s just forget about this email okay?