Alright,

I’ve figured out what this newsletter is actually going to be so this is the official official relaunch of the relaunch.

What will free subscribers get? Usually just one email a week on Fridays. It will be an end of week update consisting of:

Current portfolio size, YTD performance, 1-year performance, and since inception (February 14th, 2022)

Current portfolio positions

Short news summary for the companies I own

Ability to comment on free emails

What will paid subscribers get?

The free email on Fridays

A paid-only email on Wednesdays

The second and last Wednesday of each month will cover exactly what I’m buying and why with my upcoming contributions. Contributions hit on the 1st and 16th of each month.

The first and third Wednesday will be a deep dive. Usually it will be of a tech/SaaS company because they are way more fun to learn about than dividend payers.

One live Zoom call per month to discuss the monthly deep dives, performance, ask questions, have fun talking to real, decent humans, etc. The first one will be Wednesday, April 6th at 12:00pm EST. These will be recorded and sent to paid subscribers in case you can’t make it.

Comments on all posts (happy to turn this into a more premium community if/when there is enough interest)

Stay subscribed or subscribe if you’re into it. Unsubscribe if you hate it. Whatever you do, may the odds be ever in your favor.

Now for the portfolio update.

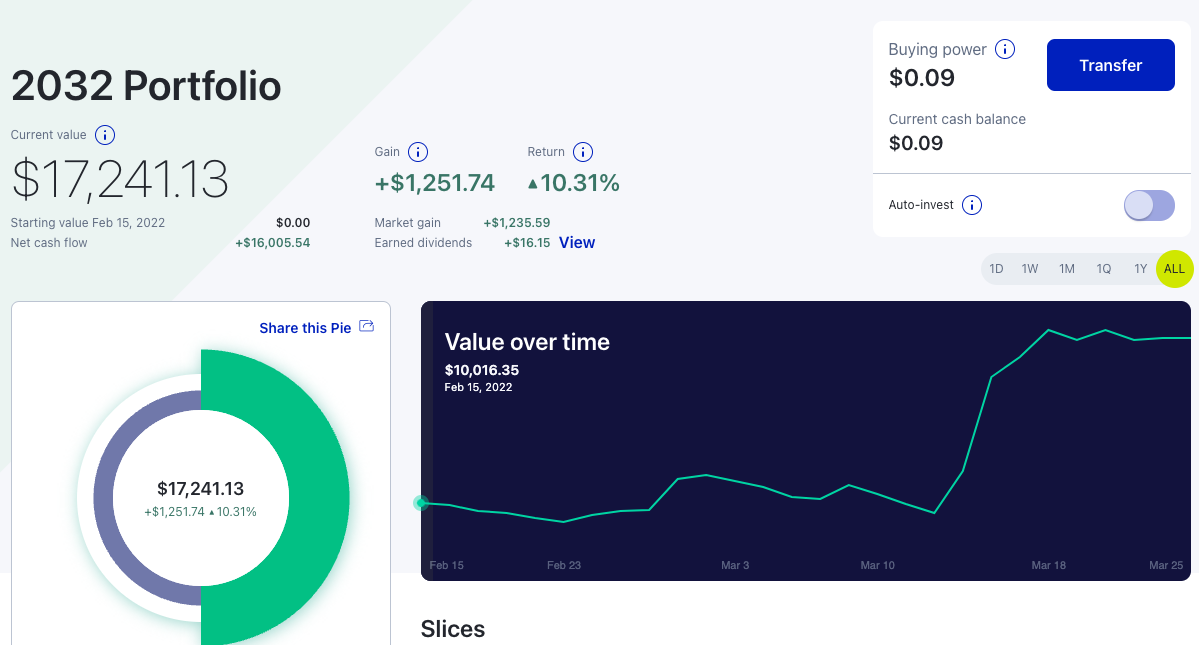

This portfolio was started on February 15th, 2022 with $10,000 (see the green dot on the very left of the first image below). Since Feb 15th, I have contributed an additional $6,000. The portfolio has gained a total of $1,251.74 from capital appreciation and dividends. so it’s up 10.31% in a little over a month. Mostly because of lucky timing. I contribute $3,000 total each month ($1,500 on the 1st and 16th of every month). If things are super doomsday, end of the world bearish, I might double the contribution (like I did this month see the second image below).

You can see I have creatively named this portfolio the “2032 Portfolio”. Ideally, it will be invested a lot longer than that, but no one would care about anything beyond 10 years from now…most people are focused on next week.

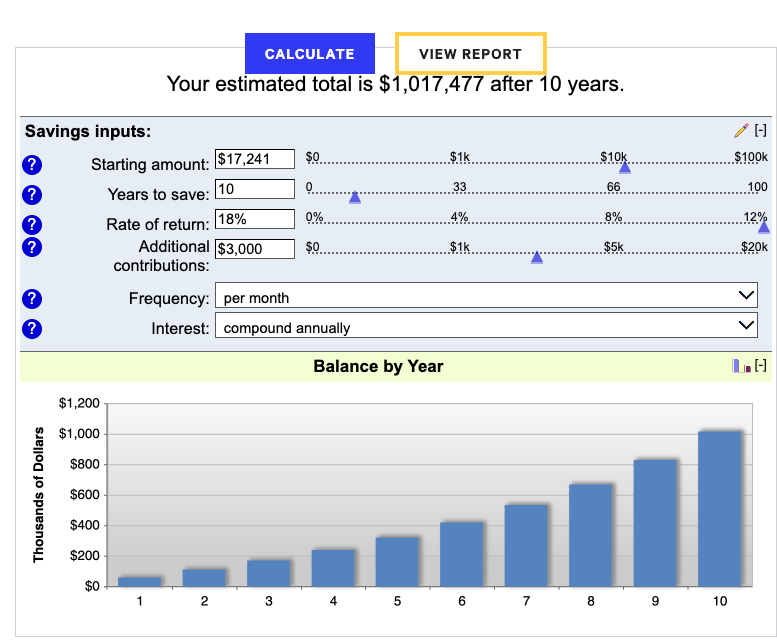

Anyways, over the next 10 years, my goal is to grow this into a $1,000,000 portfolio. Here are two paths to get there.

Path #1: Contribute $3000/month and earn 18% a year CAGR. That would make me one of the best investors of all time. Awesome if it happens, but unrealistic expectations.

Path #2 Contribute $5,000 a month on average and earn a 10% CAGR. This is a much more achievable outcome from a return perspective AND it has the double benefit of me having to invest more which means keeping lifestyle creep in check.

In the past, I’ve been extremely growth-oriented in my investing. That caused me to make a lot of mistakes and completely ignore valuation at times. Big mistake.

With this portfolio, since I’m sharing everything publicly from start to finish and will obviously be a mega-influencer overnight (just kidding), I do intend to invest a bit more responsibly.

It doesn’t mean I’m not going to own growth stocks. It means I will be more mindful of valuation and forward growth expectations.

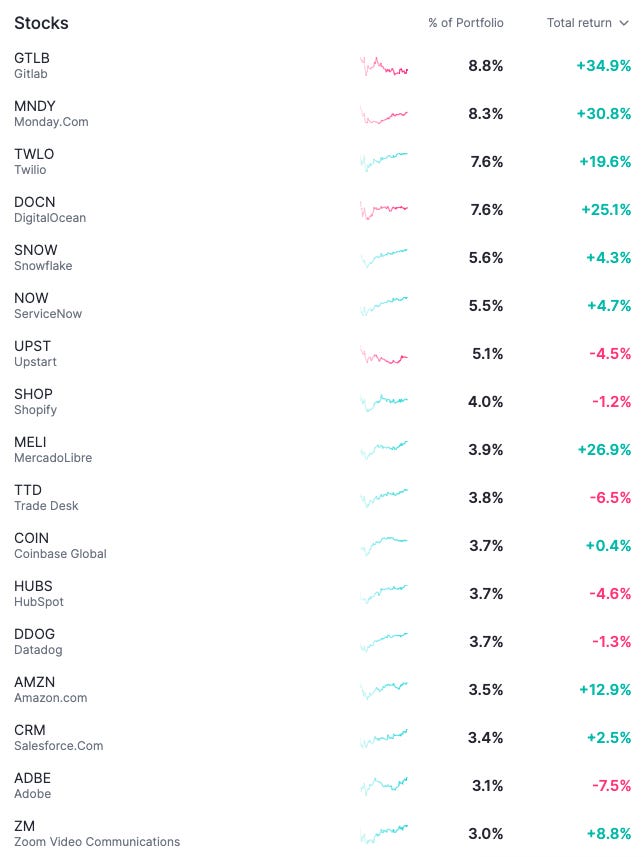

Right now because of the crazy sell-off in growth/SaaS stocks most of this portfolio is invested in Growth/SaaS stocks.

You can see that so far, that has been a good call. The growth bucket is up 19% and dividend growers are down 2%

As the multiples expand again in growth companies, I will focus more on building up the dividend side of the portfolio because that’s where the best opportunities will inevitably be.

My April purchases will most likely be heavily weighted towards dividend stocks because I want to get the portfolio closer to 50% growth, 50% dividend.

Anyways, this stuff is nuanced and it’s exactly why I’ll be sharing what I’m going to be doing and then what I own alongside my deep dives.

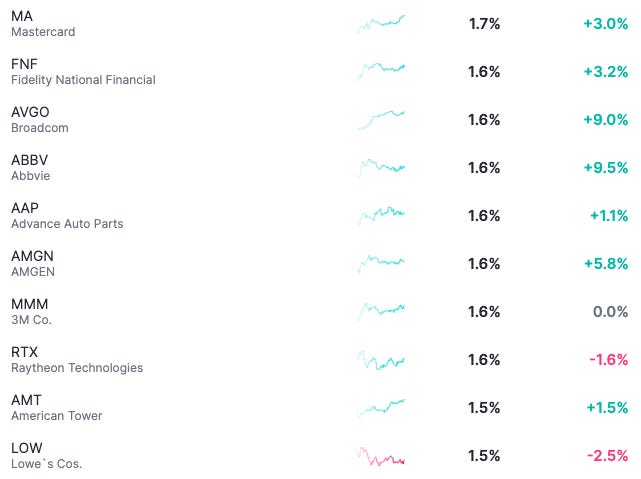

We talked about the performance so far and my plans moving forward. Here is the current position sizing of the portfolio. It’s important to note, that over the next 12 months the portfolio will be receiving at least $36,000 in new contributions.

So GitLab being a 9% position really isn’t that risky when considering the size of the position now compared to the 120 months of contributions I have coming in over the next 10 years. After a few years, I’ll have to be more careful about any single position representing too large of a portion of my portfolio.

As a reminder, you can always see my portfolio and position sizes on Commonstock

That’s it for my current portfolio update

Something I also intend to do…and this might be a horrible idea, is share the growth of this newsletter. Being a “creator” is a very real opportunity these days, but it definitely has its challenges.

By sharing my journey, I hope to give clarity, inspiration, or a warning to never attempt this to anyone considering this.

So here it is!

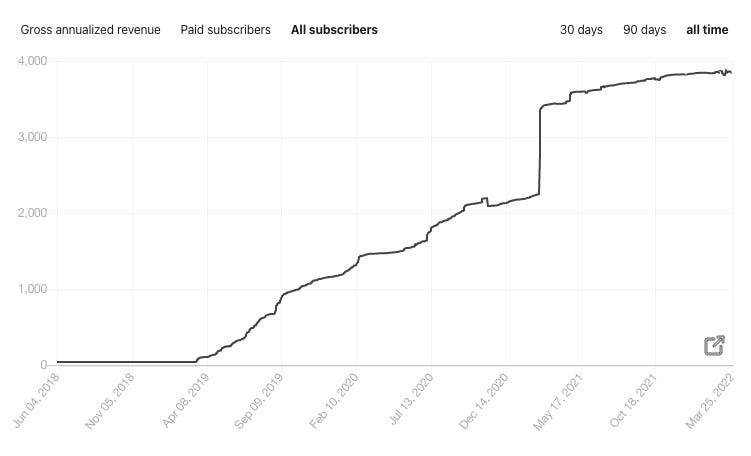

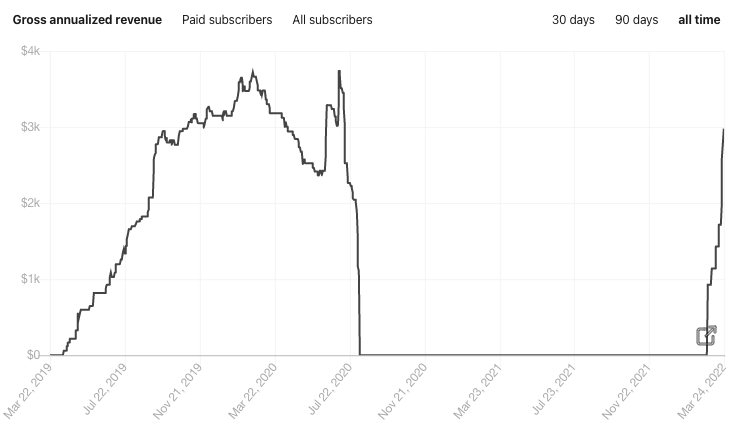

I have 3,849 total subscribers and $2,979 in gross annualized revenue. Substack takes a 10% cut and then there’s like a 3% fee from Stripe. The graph looks funky because I used to run this as paid, then turned off the subscription and refunded everyone’s money when I had restrictions due to my job.

So basically….this would not be a sustainable job at this point 😅

The price of subscribing will never go lower and I will never offer a coupon or discount. That wouldn’t be fair to paying subscribers. I’m not threatening to raise prices anytime soon or trying to force anyone to subscribe, but want to be very transparent.

Coming up next week:

Wednesday, March 30th: What I’m buying on the 1st and why (paid)

Friday, March 1st: Weekly update & News (free)

Wednesday, April 6th Deep Dive #1 and Live Zoom (Paid)

If for some reason you want to get the free emails or if you’re extra crazy and want to pay money for this madness subscribe now! I’m an awesome salesperson I know

You can also help by sharing, commenting, or liking this!

Good update